Call or Text (574) 601-3340 to get a cash offer on your house!

How to Avoid Foreclosure by Selling Your Home

Mar 04, 2023

These past few years have been difficult for everyone, and many people have struggled to maintain control of their financial situation. Homeowners might find their financial footing isn't as secure as they thought it would be when they first locked in their mortgage terms.

If a borrower falls behind on their mortgage payments for an extended period of time, the lender may send a pre-foreclosure notice and begin the foreclosure process. The homeowner will be forced to vacate the property, receive no proceeds from the auction, and suffer other repercussions.

Is there any way to prevent this from happening? Will selling the house help you avoid foreclosure? This article aims to guide you on how to sell your home to give you peace of mind in the event of a foreclosure.

What Is Foreclosure?

When homeowners default on their mortgage loans or fall too far behind in payments, banks and other mortgage lenders can start foreclosure to make up their losses. When a mortgage is used to fund a home purchase, the borrower is expected to repay the loan on a monthly basis until the balance is zero.

In the event of a job loss or other financial trouble, the lender may try to recoup some or all of the debt by selling the home.

Consequences Of A Foreclosure

Foreclosure has repercussions beyond only the loss of your home. You may suffer long-term repercussions in the form of taxes or lost credit by as many as 150 points for as long as seven years.

A foreclosure, for instance, is treated as debt forgiveness by the Internal Revenue Service. That means the IRS could classify the thousands of dollars you owed on your home at the time of foreclosure as "income" and tax you on it as such.

After foreclosure, getting a new mortgage is possible, but it could take a while if your credit has taken a hit. Avoiding foreclosure by quickly selling your home is one approach to lessen the financial and emotional impact.

The idea of foreclosure can make you feel helpless, but there may be more ways out than you think. If you're having difficulties keeping up with your mortgage payments, doing nothing is usually your worst option.

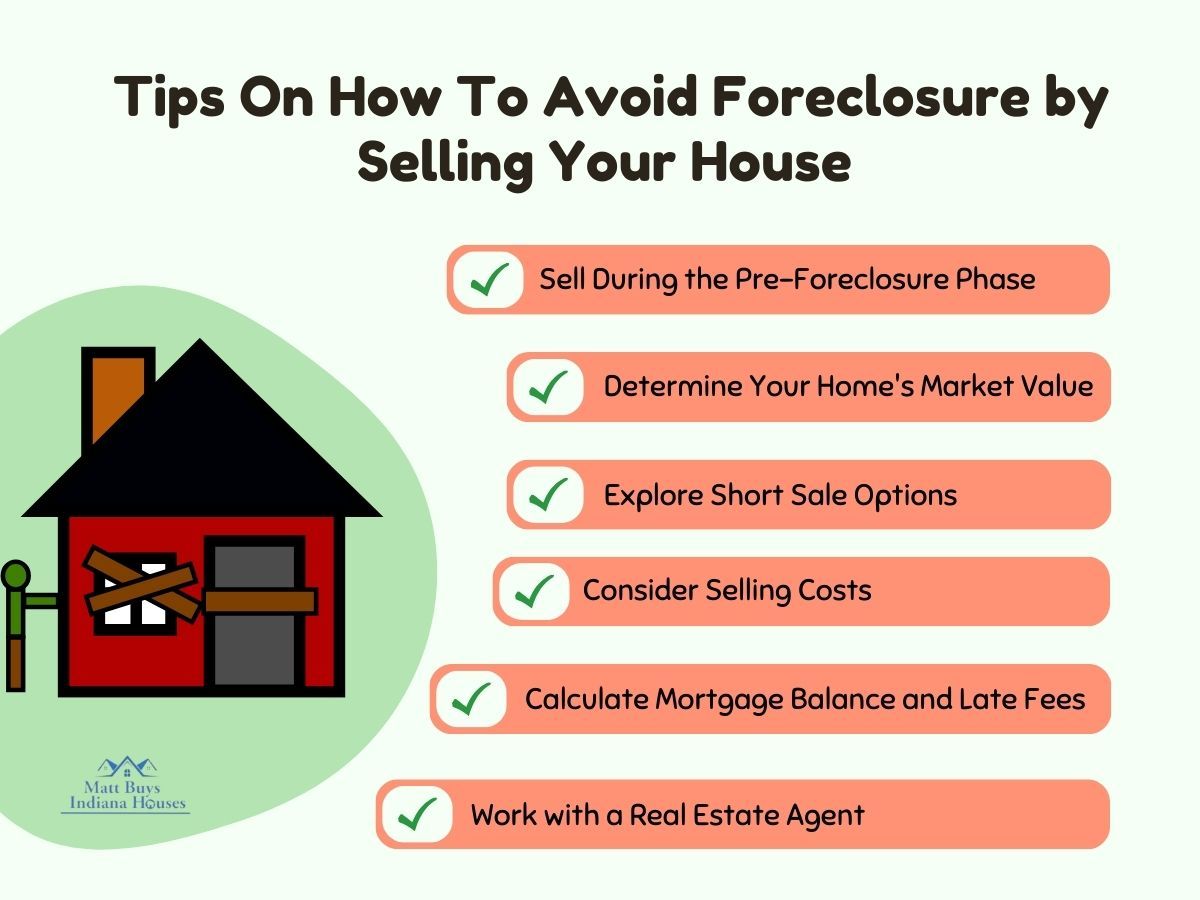

6 Tips On How To Avoid Foreclosure by Selling Your House

Many homeowners who face the prospect of foreclosure try to sell their properties in an effort to avoid it. When homes take longer than usual to sell, foreclosure rates tend to be higher than in a seller's market.

How should a homeowner proceed? Do everything it takes to get your house sold quickly. If you want to sell your home quickly, the only things under your control are the price, the marketing, and the condition.

Here are six steps and industry secrets that will make your home sell quickly.

1. The Best Time To Sell Your House

Usually, the greatest time to sell is during the pre-foreclosure phase. You can get the most money out of your home's sale if you've had months before the bank starts the foreclosure process.

State and mortgage lender regulations and procedures can greatly affect the length of time it takes to foreclose. The Department of Housing and Urban Development notes that mortgage firms frequently initiate foreclosure proceedings between three and six months following the first missed mortgage payment.

A Demand or Notice to Accelerate letter is sent after a debtor has gone more than three months without making a payment. The amount you owe is detailed in this letter, along with a standard 30-day grace period in which to pay it off. Lenders use registered mail because they can prove communication for legal purposes.

According to HUD's standards, if you do nothing to resolve your mortgage arrears within two to three months of receiving a Demand Letter, your home will be sold at auction.

2. Find Out Roughly How Much Your Home Is Worth

The real estate market prices fluctuate constantly depending on whether it is a buyer's or seller's market. Selling your house in a seller's market would be advantageous.

Do some research on similar homes in the area, and don't waste time attempting to recover imaginary equity. Your home's fair market worth is unaffected by the fact that you paid thousands more than homes nearby.

Don't ask too much for your home and know exactly what you're looking for. If you want to sell your home quickly, you need to price it aggressively, which means low, because some buyers would pass it over if they think it's too expensive.

Some buyers will only look at houses listed by owners who appear to be reasonable in their asking prices. The lowballers will emerge if you let your home sit on the market for too long.

If you want to sell your home quickly, you should base your asking price on the actual sales prices (not the asking prices) of previously sold homes in the region, minus five to ten percent. A home that is priced just a little below market value will look like a steal to potential buyers, increasing the likelihood that a serious offer will be made.

3. Determine Your Mortgage Balance Plus Any Applicable Late Fees

Get in touch with your lender and find out exactly how much you'll owe if you decide to sell. If you've received a foreclosure notice, it's likely that you're several months behind on your mortgage payments.

You'll have to pay everything, plus interest and penalties for being late, when you sell your house. Mortgage companies often begin charging late fees once a payment is late by 10 to 15 days.

The mortgage company's lawyer might have also charged you fees because of your arrears. Take the total amount of principal and interest that is still left on the mortgage and look at any recent foreclosure notices sent by the bank and deduct that amount from the amount you expect to receive from the sale.

4. Subtract Selling Fees

Even when a home is in foreclosure, selling it will cost some money. In addition to the real estate agent's compensation, closing charges, seller concessions, and relocation expenses must be subtracted from the sale price.

Hopefully, you'll end up with a positive net income and some spare change. If the money from the sale isn't enough to pay the mortgage and other bills, you'll need to bring in additional funds. If you don't have the cash necessary to close the deal, you'll likely have to consider a short sale.

Short Sale

In a short sale, the lender agrees to accept less than the full amount owed on the mortgage in exchange for receiving the selling proceeds and forgiving any residual balance. If your lender agrees to a short sale, you may be able to save some of your equity.

You may want to work with a real estate agent who has experience in short sales to help you find a buyer and go through the lengthy process of getting the appropriate clearances. You can ask your lender for a short sale if your home sale won't cover your mortgage.

In a short sale, the lender accepts less than the entire sum of the mortgage and forgives the rest in order to facilitate the selling of the home.

5. Marketing Your House

Instead of going through this process alone, you should contact a real estate agent that has experience helping people sell their homes before they go into foreclosure. Get an experienced aget since the homeowner's chances of selling the house in time are diminished if the agent is unprepared and asks the wrong questions.

It is your real estate agent's job to advertise your home, but you still need to see to it that it gets done. Most homebuyers today begin their search on the internet, so it's important that your property is featured on all the major real estate portals and on your agent's and your own social media profiles.

Use images, and don't be shy about using many images. Potential buyers will spend more time on your ad and be more interested in visiting your house if more images are included.

Don't overspend, but do your best to keep the house in good shape. Prioritize things like paint and carpet that are easy on the wallet but have a big visual impact.

6. Keep In Close Touch With Your Lender

It's important to keep in touch with your lender, even if you'd rather ignore the phone calls and letters. Most lenders would rather cooperate with you to sell your house than foreclose and sell it at a loss, so keep them updated on your strategy even if it changes.

As such, your agent should be in communication with the lender. After acquiring as much pre-foreclosure information as possible, they collaborate with the bank, asset manager, or foreclosure specialist.

The bank still loses money on a foreclosure, even if the house has equity and could be sold for more than the mortgage. Lenders aren't in the business of buying and selling property and don't want to keep it on their books if they don't have to.

They might delay the foreclosure process (voluntarily or legally) if a sale is underway.

How Long Does It Take To Sell A Foreclosure Home?

Selling a foreclosure home is similar to selling a regular property. Pricing, condition, and the local market determine a home's sale time, not foreclosure status.

When facing foreclosure, you must market your home honestly and competitively. If priced correctly, it will sell within a week or two.

However, foreclosure shouldn't compel you to sell your house for less than it's worth. There's no duty to disclose a foreclosure to purchasers, but you should tell your realtor so they can price the home to sell quickly.

Most buyers' agents won't check tax records for foreclosure. They won't know you're in financial trouble, so you may get fair market value for your house instead of lowball offers.

Only when you've waited too long and face a hard sell-by date owing to approaching foreclosure can you disclose it to speed things along.

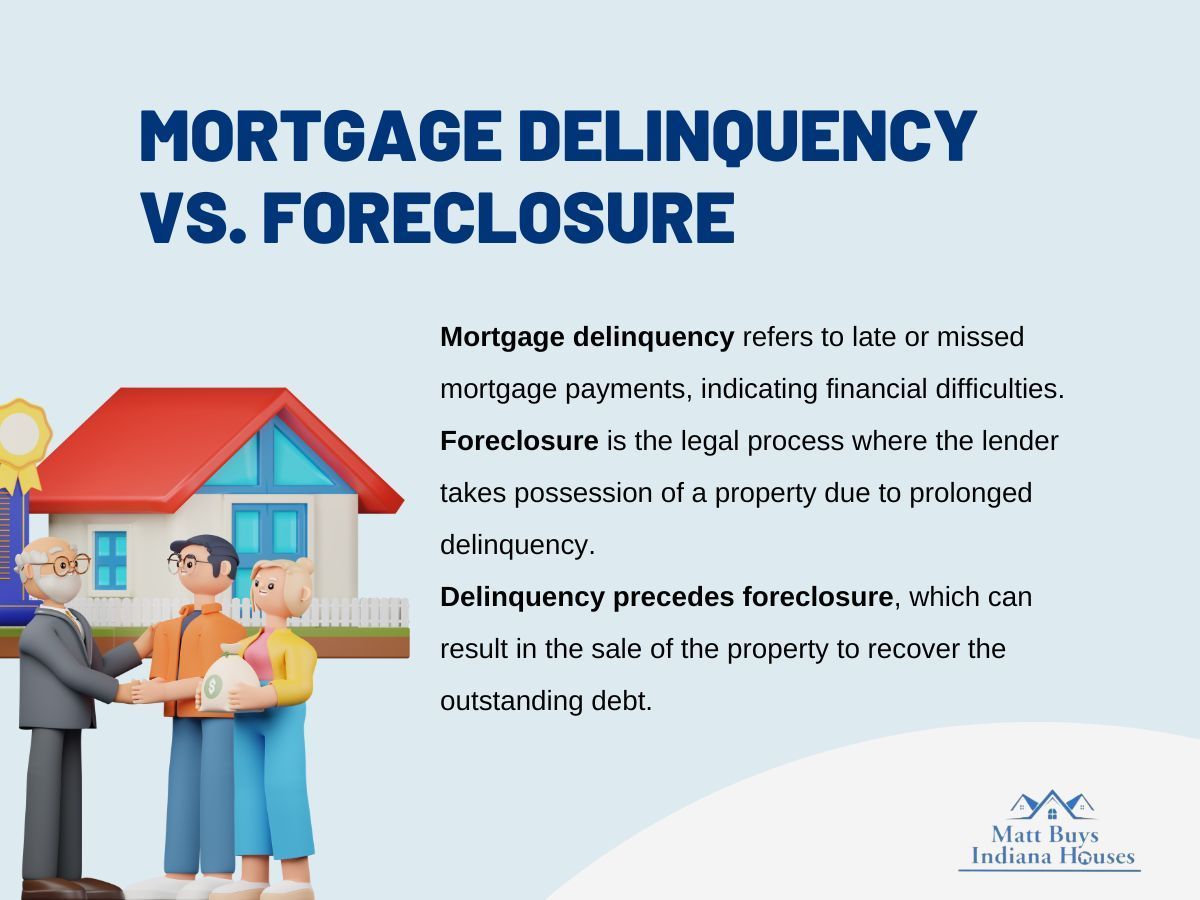

Mortgage Delinquency Vs. Foreclosure

A mortgage is considered delinquent if at least one payment has not been made within 30 days of the due date. Homeowners who fall behind on their mortgage payments may incur late fines and credit damage, but they still have options to avoid losing their homes to foreclosure.

The initial phase of the foreclosure procedure is known as pre-foreclosure. Delinquency on a mortgage means the borrower has fallen behind on their payments and may face foreclosure action from their lender.

This grace period gives borrowers breathing room to renegotiate terms with their lenders and get their mortgages back on track.

When Is It Too Late To Stop Foreclosure?

No one ever plans to go through foreclosure on their property. You may still be responsible for paying the deficit or the leftover balance on the mortgage, even if your home sells at auction for less than the amount owed after the foreclosure process.

Since the home has been sold, any remaining deficit is considered a kind of unsecured debt. If the bank sues you for the shortfall and wins, it will have the right to collect by placing liens on other assets you possess, garnishing your salary, or freezing your bank accounts.

The fear of losing one's home can be crippling, but it's important to know that there are ways to prevent or postpone foreclosure, even at the eleventh hour. Understanding foreclosure, knowing your rights, and being proactive can change the outcome.