Call or Text (574) 601-3340 to get a cash offer on your house!

Six Skills Real Estate Investors And Developers Should Focus On Mastering

Dec 04, 2018

The real estate development and investment industry is a dynamic, ever-changing field that presents both amazing prospects and difficult obstacles. Are you curious about the keys to becoming a

profitable real estate investor?

One of the few sectors where people with a variety of talents and skills may make a lot of money and improve their financial situation is the real estate industry. A strategic attitude, expertise, and agility are necessary for successful market navigation.

Real estate investors don't need to research, evaluate, and understand every market on the planet, but they do need to have a foundational understanding of the industry in order to have a successful career.

1. Market Analysis and Research

Your real estate projects are guided by market analysis as your compass. It entails evaluating the market situation at the moment, seeing patterns, and comprehending the local, regional, and national variables that may impact the real estate market.

You are effectively working in the dark if you don't have a thorough understanding of the market. Expert investors polish their capacity to find out everything there is to know about the assets that they trade, but even more crucially, they learn how to predict with precision how that information will probably affect a certain market.

- Stay Updated with Market Trends and Data

Master traders learn and perfect by utilizing market information – both fundamental economic information and market information in the form of trading and price action that occurs.

Mastering market analysis involves making data-driven decisions. Using market data and research to inform your choices when acquiring properties, setting rental rates, or deciding on development projects can help you make informed, profitable decisions.

Successful real estate professionals continuously monitor market trends and collect relevant data. This includes tracking property values, rental rates, demand, and supply. Embracing technology and data analytics can provide valuable insights and a competitive edge.

- Adaptability

In the real estate industry, technology has changed from traditional word-of-mouth marketing to AI-supported decision-making. As an investor, you must adjust with the times.

Always keep an eye out for new opportunities, whether they come from evolving legal requirements, industry trends, or advancements in technology. Adjust your tactics as necessary, shifting your attention from a certain kind of real estate to exploring new investment opportunities or regions.

Being a flexible and effective real estate investor means being able to seize fresh chances, get past obstacles, and get beyond unanticipated setbacks.

- Know the Market

Competent real estate investors get a thorough understanding of the markets they have chosen, for example, by concentrating on a certain area or distinguishing between residential and commercial properties. Real estate investors can recognize the state of the market and make plans for the future by staying up to date on trends, which include shifts in consumer purchasing patterns, mortgage interest rates, and the unemployment rate, to mention a few.

This allows them to forecast when trends might shift, opening up possibilities for the well-prepared investor.

- Networking and Local Insights:

Developing a strong network of industry professionals and local experts can provide invaluable insights. Local factors often influence real estate, and having a network that can keep you informed about upcoming developments, zoning changes, or community dynamics is essential.

- Continuous Learning:

Real estate markets are dynamic, and trends can change rapidly. As such, mastering market analysis is an ongoing process.

To stay on top of market intelligence, make it a practice to keep learning about new resources, tools, and research techniques. In other words, don't be scared to put in the work and become knowledgeable if you want to become a successful real estate investor.

2. Financial Literacy

Financial literacy in the real estate industry stands as a pivotal skill essential for making sound investment decisions and achieving long-term success. Financial literacy in the context of real estate encompasses a wide range of knowledge and competencies.

- Budgeting and Financial Planning:

Effective financial literacy begins with the ability to create and manage budgets. Real estate projects often involve substantial capital, and a well-structured budget is essential for keeping expenditures in check and ensuring profitability.

- Financial Modeling:

Financial modeling is a crucial tool for forecasting the financial outcomes of real estate investments and development projects. It involves projecting future cash flows, assessing risk, and estimating returns on investment.

- Risk Assessment:

Understanding the financial risks associated with real estate investments is key to mitigating potential losses. Proficiency in risk assessment helps in making informed decisions about which properties to invest in and how to structure deals.

The identification and comprehension of market conditions and patterns is a useful strategy for preventing losses. To determine whether to buy or sell, you should be able to evaluate a potential investment opportunity based on its future potential, relative risk, and amenities.

Learn about the dynamics of a place, especially what regions are in great demand. Prior to making an investment, make sure to research the job market, rental rates, property costs, and available amenities and transportation.

3. Negotiation and Communication

Effective communication and negotiation are two essential abilities that have a big impact on how deals and initiatives turn out. The capacity to view any investment opportunity beyond its current monetary value is an essential skill that every real estate investor should possess.

Instead of rushing into a purchase due of the cost, thoroughly investigate the property to ensure that you are making a prudent investment. This should not, however, imply putting up resistance to achieve your goals.

Participate actively in real estate investment agreements to guarantee that all parties receive their just compensation, and be on the lookout for transactions that don't yield a profit.

- Negotiating skills

The difference between a successful transaction and a lost opportunity in real estate transactions is the capacity to negotiate with sellers, buyers, lenders, and other stakeholders in an efficient manner. Good negotiating abilities enable investors to establish lasting connections with important industry leaders and obtain advantageous terms and prices.

Aim for win-win outcomes, seeking solutions that benefit all parties involved. This approach builds trust and fosters long-term relationships, which are valuable in the real estate industry.

- Communication Skills

Effective communication is key to conveying your intentions, requirements, and expectations clearly. It minimizes misunderstandings and facilitates smooth transactions.

Be an active listener which allows you to find common ground and address the needs of your clients. Build relationships with clients, partners, and stakeholders to build trust and make them more likely to work with you.

4. Legal and Regulatory Knowledge

Navigating the complex web of laws and regulations that govern real estate is a handy skill for real estate investors and developers. The real estate industry is heavily regulated, and failing to comply with the law can have serious consequences.

Legal knowledge helps you stay on the right side of the law and minimizes potential legal and financial risks.

- Property Rights and Title: Understanding property rights, titles, and ownership structures is fundamental to ensuring a clear and marketable title for your real estate investments. Legal knowledge can help you avoid disputes and title issues.

- Zoning and Land Use Laws: Zoning regulations and land use laws dictate what you can and cannot do with a property. Familiarity with these regulations is essential when considering development projects.

- Contracts and Agreements: Real estate transactions involve a multitude of contracts and agreements. Legal expertise is essential for drafting, reviewing, and negotiating contracts to protect your interests.

- Liabilities and Liens: Real estate can be subject to various liabilities and liens, such as mortgages, tax liens, and environmental issues. Legal knowledge helps you identify and manage these potential encumbrances.

- Environmental Regulations: Environmental regulations can significantly impact real estate transactions, especially when dealing with contaminated sites or development in sensitive areas. Legal expertise is vital for understanding and complying with these regulations.

Experienced attorneys can provide guidance, draft documents, and ensure compliance with the law. They can also conduct due diligence to identify potential legal issues or liabilities associated with a property.

Real estate laws and regulations are subject to change so a strong legal foundation is crucial to stay updated on evolving legal requirements. Keep in mind that real estate law can vary from state to state and even within local jurisdictions. Understanding the specific legal landscape in your area is essential.

5. Project Management

When projects are managed well, they are finished on schedule, on budget, and to the appropriate quality standards. You have to handle a variety of responsibilities whether you choose to buy a home or launch a real estate company.

For example, managing a real estate company involves managing a group of licensed people as well as field professionals such as property managers, real estate agents, and architects. As a landlord, you also have to manage move-ins and move-outs, collect rent, conduct property inspections, screen and select the correct tenants, and attend to tenants' wants and requests.

To optimize operations and increase your return on investment, you must have the necessary resources. It includes:

- Setting Clear Objectives

- Budgeting and Resource Allocation

- Scheduling and Timeline Management

- Effective Communication

- Quality Assurance to attract tenants or buyers

- Problem-Solving

- Team Building and Leadership

- Supplier and Contractor Management

Project managers leverage software tools for project scheduling, document management, and collaboration, which streamlines project oversight and reporting. Utilizing key performance indicators (KPIs) and project management metrics allows project managers to monitor progress and make data-driven decisions.

Real estate projects can also change due to unforeseen circumstances or evolving market conditions. Skilled project managers are adaptable and can adjust project plans as needed.

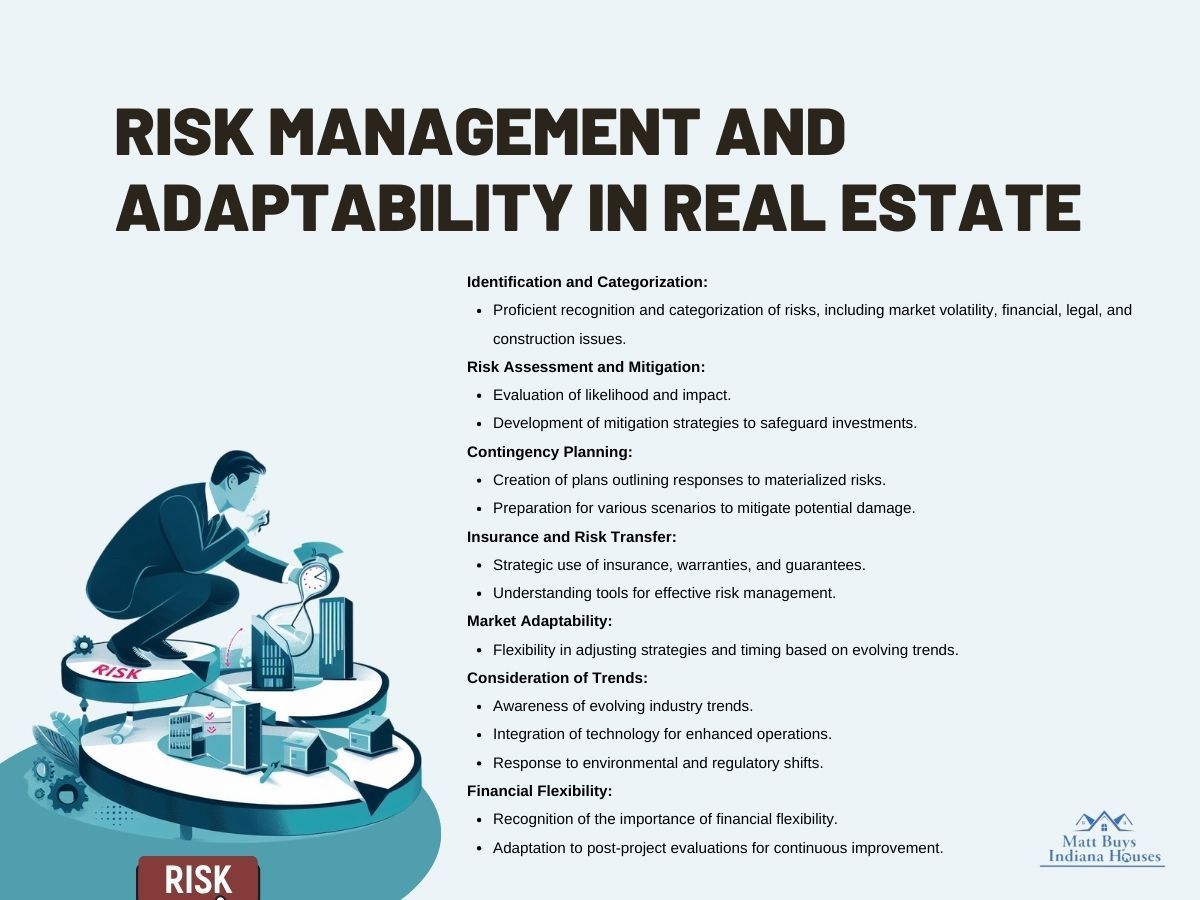

6. Risk Management and Adaptability

In the ever-evolving landscape of real estate investment and development, the ability to manage risks effectively and adapt to changing conditions is a skill that cannot be overlooked.

In the real estate industry, risks can come in various forms, including market volatility, financial risks, legal complications, and unexpected construction issues. Therefore, mastering risk management and adaptability is crucial for long-term success.

Proficiency in identifying and categorizing these risks is a fundamental step.

- Risk Assessment and Mitigation: Skilled real estate professionals assess risks by evaluating their likelihood and potential impact. They then develop mitigation strategies to reduce or eliminate these risks, safeguarding their investments.

- Contingency Planning: Part of risk management involves creating contingency plans that outline how to respond if specific risks materialize. Being prepared for various scenarios can help mitigate potential damage.

- Insurance and Risk Transfer: Using insurance and risk transfer mechanisms, such as warranties and guarantees, can be a strategic way to mitigate specific risks. Understanding how to utilize these tools is a valuable aspect of risk management.

Real estate markets are also subject to fluctuations. A skilled investor or developer can adapt to changing market conditions, adjusting their strategies and timing to maximize returns.

You need to understand:

- Evolving Trends

- Technology Integration

- Environmental and Regulatory Shifts

- Financial Flexibility

After project completion, skilled real estate professionals conduct comprehensive evaluations to assess what went well and what didn't. They use this feedback to improve future projects.

4 Surprising Factors That Can Affect a Home Appraisal

Real estate investing is a difficult business that requires knowledge, preparation, and focus despite the constant advertising that suggests it is a simple path to financial success. While there is no one-size-fits-all-all, the following core skills can help you become an excellent real estate investor in this dynamic industry.

Now that you're equipped with these essential skills let's shift our focus to the intricacies of selling houses. Understanding the factors that can affect a home appraisal is crucial for ensuring that your properties are accurately valued in the market.

This will undoubtedly enhance your prowess in the real estate arena and elevate your success as a real estate professional.