Call or Text (574) 601-3340 to get a cash offer on your house!

If a House Is in a Trust, Can It Be Sold?

Oct 04, 2023

If you're considering selling a house in a trust, you may wonder if it's even possible. The answer is yes, but there are some important things to remember. In this blog post, we'll explore the process of selling a house that's in trust and what you need to do to make it happen.

Whether you're a homeowner, a trustee, or just curious about the process, this post will provide the information you need to make an informed decision. So, let's dive in and learn more about selling a house in a trust.

Understanding Trusts and Their Types

When it comes to estate planning, trusts are powerful tools that can help you manage and distribute your assets efficiently. It's crucial to understand what trusts are and the different types available. To make informed decisions about selling a house held within a trust. Let's delve deeper into this topic and explore the world of trusts.

What Is a Trust?

At its core, a trust is a legal entity that holds and manages assets for the benefit of individuals or organizations. Trusts are designed to provide a structured framework for the management and distribution of assets, offering a range of benefits that can include asset protection, probate avoidance, privacy, and tax planning.

Types of Trusts

Several types of trusts are tailored to specific goals and circumstances. Let's explore three common types of trusts and their unique characteristics:

1. Revocable Living Trust

A Revocable Living Trust is a versatile estate planning tool that allows you to maintain control over your assets during your lifetime. Here are some key features:

- Control: As the grantor (creator of the trust), you can make changes, amend, or even revoke the trust at any time while alive and mentally competent.

- Probate Avoidance: One of the primary advantages of a Revocable Living Trust is its ability to bypass the probate process. Upon your passing, assets held in the trust can be distributed to your beneficiaries without going through probate court, saving time and reducing administrative costs.

- Privacy: Unlike a will, which becomes a public record upon your passing, a Revocable Living Trust maintains privacy. The trust document and its provisions remain confidential.

- Flexibility: You can use a Revocable Living Trust to manage various assets, including real estate, investments, and personal property.

2. Irrevocable Trust

An Irrevocable Trust, as the name suggests, is a trust that cannot be easily altered or revoked once established. This type of trust serves various purposes, with asset protection and estate tax reduction being two primary objectives:

- Asset Protection: Assets in an Irrevocable Trust are typically shielded from creditors, lawsuits, and potential legal liabilities. This protection can be crucial for safeguarding your assets for future generations.

- Estate Tax Reduction: By transferring assets into an Irrevocable Trust, you may be able to reduce the overall value of your taxable estate, potentially lowering estate tax liabilities.

Consent of Beneficiaries: Irrevocable trusts often require beneficiaries' consent to make changes, making it essential to carefully plan and consider the trust's terms.

3. Testamentary Trust

A Testamentary Trust is unique because it is created within a will and becomes effective only after the grantor's passing. Here are some key aspects of this type of trust:

- Posthumous Control: While you can't change a Testamentary Trust after your passing, it allows you to specify how your assets should be managed and distributed once certain conditions are met.

- Incorporating Specific Wishes: Testamentary trusts are often used to achieve specific goals, such as providing for minor children, ensuring responsible wealth management, or supporting charitable causes.

- Estate Planning Integration: These trusts are part of your overall estate plan and are designed to work with your will.

Choosing the Right Trust

Selecting the right trust for your needs is a critical decision in estate planning. Factors such as your goals, the nature of your assets, and your desire for control will influence your choice.

It's essential to consult with an experienced estate planning attorney or financial advisor who can assess your unique circumstances and help you create a tailored plan.

Reasons for Placing a House in a Trust

Placing your house in a trust is a strategic estate planning move offering several compelling advantages. Let's explore these reasons to understand why many individuals choose this approach.

1. Asset Protection

Asset protection is one of the primary motivations for placing a house in a trust. Trusts are powerful tools for shielding your property from potential creditors and legal liabilities. Here's how it works:

- Creditor Protection: When your property is held in a trust, it becomes more challenging for creditors to claim it. In many cases, creditors cannot access assets placed in an irrevocable trust, providing a protective barrier around your property.

Lawsuit Safeguard: In case of a lawsuit or legal judgment, the property held in a trust may be safeguarded from the reach of claimants, preserving your valuable assets for your intended beneficiaries.

2. Probate Avoidance

Probate is the legal process by which a deceased person's assets are distributed, debts are settled, and the estate is closed. Placing your house in a trust can help your heirs avoid probate court's complexities and potential delays. Here's how:

- Streamlined Distribution: Assets held in a trust typically bypass the probate process. Upon your passing, the trust's provisions dictate the distribution of your property directly to your beneficiaries, making the transition smoother and more efficient.

- Reduced Costs: Probate proceedings can be costly, with fees that may include attorney's fees, court costs, and executor compensation. By avoiding probate, you can reduce the overall expenses associated with estate administration.

3. Privacy

Privacy is another significant benefit of using trusts in estate planning. Unlike wills, which become part of the public record, trust documents and their provisions generally remain confidential. Here's why this matters:

- Confidentiality: Trusts allow you to maintain a degree of privacy concerning your financial affairs and the distribution of your assets. This confidentiality can be especially appealing if you value discretion in your estate matters.

Minimized Public Scrutiny: A trust's contents and the identities of your beneficiaries are not subject to public scrutiny, protecting unwanted attention or disputes.

4. Control and Succession Planning

Trusts provide a structured and flexible way to manage and distribute assets according to your wishes. This level of control is invaluable for those who want to ensure their property is managed and distributed in a specific manner:

- Customized Management: Trusts allow you to outline detailed instructions for managing your assets, including how they should be invested, used for specific purposes (e.g., education or charitable giving), and distributed over time.

- Beneficiary Support: If you have specific intentions for financial support to family members or loved ones, a trust can be designed to meet these goals, even after your passing.

Succession Planning: Trusts can be critical in succession planning for family businesses or properties. They can help ensure a smooth transition of ownership while preserving the property's value and integrity.

Can a House in a Trust Be Sold?

Yes. Selling a house within a trust is possible, but it involves a distinct process and consideration compared to selling a property in your name. This comprehensive guide will explore the steps and key aspects involved in selling a house held within a trust.

1. Preparing the House for Sale

Just like any property sale, the process begins with preparing the house for the market. Here are some essential steps:

- Assessment and Repairs: Evaluate the property's condition and address any necessary repairs or renovations to enhance its marketability and value.

- Staging: Consider staging the house to make it more appealing to potential buyers. Staging involves arranging furniture and decor to showcase the property's potential.

- Pricing: Determine an appropriate listing price for the house. This should be based on market conditions, property appraisals, and consultation with a real estate professional.

Curb Appeal: Enhance the property's curb appeal by maintaining the landscape, cleaning the exterior, and ensuring the property looks inviting to potential buyers.

2. Obtaining the Necessary Legal Documents

Before proceeding with the sale, ensuring that the legal aspects are in order is crucial. Your trustee will need specific documents to demonstrate their authority to sell the property. These documents may include:

- Certification of Trust: This document provides evidence of the trust's existence and the trustee's authority. It often includes key provisions of the trust while keeping sensitive details confidential.

- Deed Showing Trust Ownership: A deed should be prepared, showing the trust as the legal owner of the property. This deed may need to be recorded with the local government to update property records.

- Trust Agreement: The full trust agreement, which outlines the trust's terms and conditions, may need to be made available to potential buyers or their representatives upon request.

Authorization for Sale: Ensure that the trust agreement explicitly authorizes the sale of trust assets, including the house. This authorization may include details on how proceeds should be distributed.

3. Hiring a Real Estate Agent or Broker

While the trustee can handle the sale independently, many trustees opt to enlist the services of a qualified real estate agent or broker. Here's why:

- Market Expertise: Real estate professionals have in-depth knowledge of local markets, pricing trends, and marketing strategies, ensuring your property is positioned optimally for a successful sale.

- Marketing and Exposure: Agents and brokers can effectively market the property to a wider audience, leveraging their networks and advertising resources.

- Negotiations: Experienced agents are skilled negotiators who can represent the trust's interests during price negotiations and contractual discussions.

Legal Compliance: Real estate agents are well-versed in property transactions' legal requirements and paperwork, reducing the risk of errors or oversights.

4. Marketing and Selling the Property

The marketing and selling phase begins once the property is ready and a real estate professional is on board. Here's what it entails:

- Listing the Property: The agent or broker will create a compelling listing, including high-quality photos, descriptions, and details about the house's features and amenities.

- Showing the Property: Potential buyers and their agents will schedule viewings to inspect the property. The trustee or their agent will facilitate these showings.

- Receiving Offers: Interested buyers will submit offers, which the trustee will review and consider. Negotiations may ensue to reach an agreement on price and terms.

Accepting an Offer: Once an acceptable offer is received, the trustee, with guidance from their agent, will accept the offer and move forward with the sales contract.

5. Closing the Sale and Distributing Proceeds

The closing process is the final phase of selling a house in a trust. During this stage:

- Title Search and Inspection: A title search ensures no encumbrances or legal issues with the property's title. The buyer may also perform inspections.

- Signing the Closing Documents: The seller (trustee) and buyer sign the necessary closing documents, including the deed of sale, transfer of ownership, and any other required paperwork.

Distribution of Proceeds: Once the sale is complete, the proceeds from the sale are typically held within the trust. The trustee will then distribute the funds according to the trust's terms, which may involve providing beneficiaries with their respective shares.

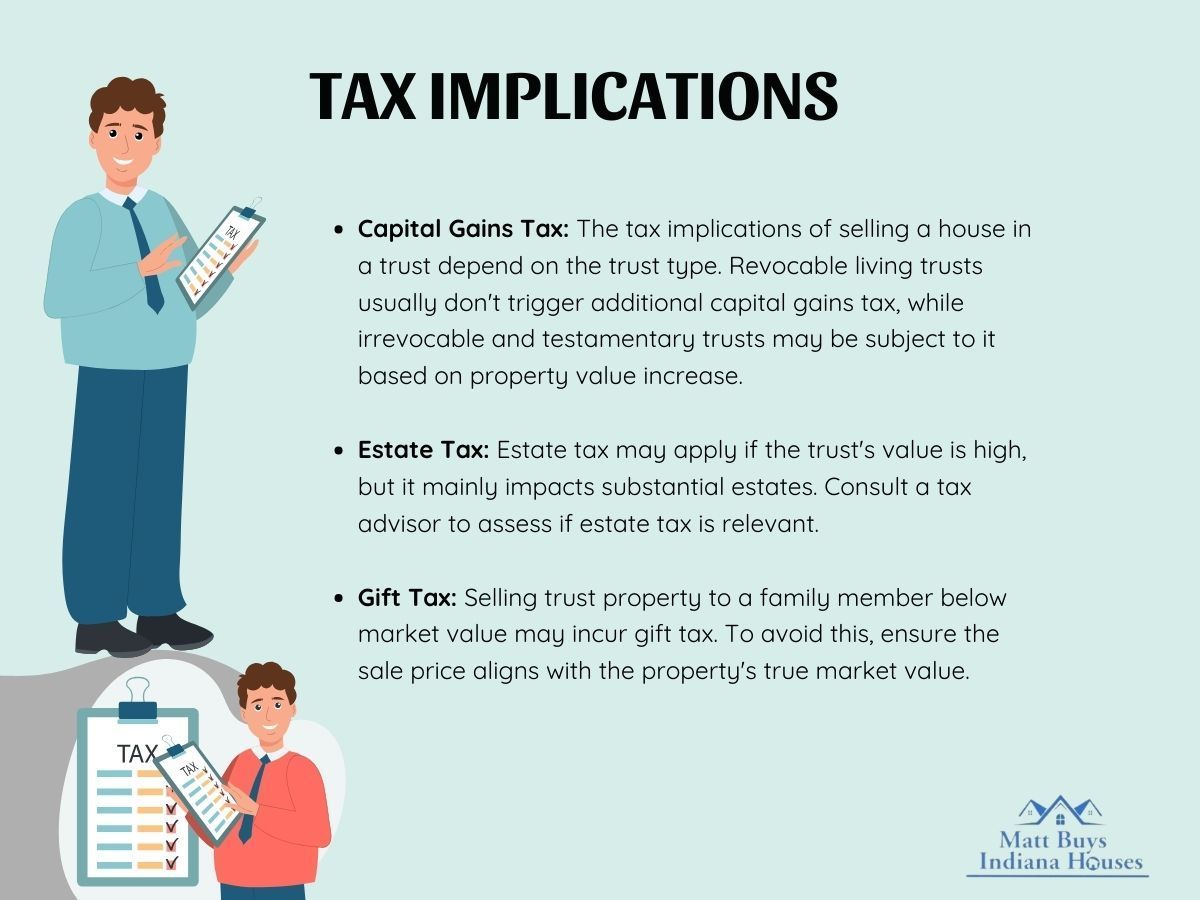

Tax Implications

When selling a house held within a trust, it's essential to consider the potential tax implications that may arise. Here are key tax considerations that trustees and beneficiaries should be aware of:

1. Capital Gains Tax

Capital gains tax is a significant concern when selling real estate, including a house held in a trust. The tax implications can vary based on the type of trust and the gain realized from the sale.

- Revocable Living Trust: Generally, selling a property in a revocable living trust does not trigger additional capital gains tax, as the trust is considered a pass-through entity for tax purposes. The trust's income and capital gains are reported on the grantor's tax return.

- Irrevocable Trust: Irrevocable trusts are separate taxable entities. When a house held in an irrevocable trust is sold, the trust may be subject to capital gains tax based on the increase in the property's value since it was transferred to the trust. The tax rate depends on the trust's income tax bracket.

Testamentary Trust: Similar to irrevocable trusts, testamentary trusts are separate taxable entities, and the sale of a house in such a trust may incur capital gains tax.

2. Estate Tax

Estate tax is another consideration, particularly if the value of the trust exceeds certain thresholds. An estate tax is a federal tax imposed on the transfer of wealth upon an individual's death.

However, the estate tax exemption threshold is relatively high, which means that only estates with substantial assets are subject to this tax. It's essential to consult with a tax advisor to assess whether estate tax may apply to your specific situation.

3. Gift Tax

If a property held in a trust is sold to a family member at a price significantly below the fair market value, there may be potential gift tax implications. The Internal Revenue Service (IRS) closely scrutinizes transactions between family members to prevent the avoidance of gift tax liabilities.

Ensuring the sale price reflects the property's true market value is important to avoid potential gift tax issues.

Potential Challenges and Solutions

Selling a house in a trust can present several challenges, but proactive planning and communication can help navigate these obstacles effectively.

1. Communication is Key

Open and transparent communication among beneficiaries is crucial to avoid conflicts during the sale process. Beneficiaries should be informed about the sale, its implications, and the distribution of proceeds according to the trust's terms.

Addressing any concerns or questions in advance can help prevent disputes and maintain family harmony.

2. Consult Legal Professionals

Navigating the sale of a house in a trust can be complex, given the legal and tax considerations involved. To ensure compliance with legal requirements and maximize the trust structure's benefits, consult with experienced attorneys specializing in trusts and estates.

These professionals can guide tax planning, trust administration, and the proper execution of the sale.

Conclusion

Selling a house within a trust is feasible and strategic, offering benefits such as asset protection, probate avoidance, and privacy. However, it's essential to be aware of potential tax implications, including capital gains, estate, and gift tax.

Careful planning, consultation with legal and financial professionals, and open communication among beneficiaries are critical elements for a successful and well-executed sale.

By addressing these considerations, trustees and beneficiaries can confidently navigate the sale process while fulfilling the trust's objectives and intentions. Trusts remain powerful tools for asset protection and estate management, and with the right guidance, individuals can harness their benefits effectively.